The term Family Office often evokes images of bullet-proof glass, billionaire dynasties, and vast financial empires. But what exactly does it mean, how has it evolved, and why is it becoming increasingly relevant even beyond the ultra-wealthy? In this post we’ll explore: the definition and functions of a family office; the types, benefits and challenges; recent trends (including what’s happening in 2025); and a few real-life examples of how prominent family offices are operating today.

What is a Family Office?

At its core, a family office is a private entity created to manage the affairs of a wealthy family. According to one standard definition:

“A family office is a private wealth-management advisory firm that serves ultra-high-net-worth individuals (UHNWIs).” (Investopedia)

The key features include:

-

It is single-family (serving one family) or multi-family (serving multiple families) in structure. (Investopedia)

-

It goes beyond mere investment management: it may include tax-and-estate planning, philanthropy, governance, lifestyle services (e.g., staff, travel), and succession planning. (Wikipedia)

-

The objective is often both wealth preservation (across generations) and wealth growth, aligned with the family’s values, identity and long-term legacy. (Family Office)

An excerpt from one resource captures the intent:

“The family office is a unique family business created by and for a single family to provide tailored wealth management solutions … while promoting and preserving the family’s identity, unity, and values.” (Family Office)

In other words, unlike a simple portfolio or private-wealth advisory firm, a family office combines investment, lifestyle and legacy functions in one integrated structure.

Why Do Families Set Up Family Offices?

There are multiple motivations and benefits:

-

Complexity of wealth: When a family has substantial assets (often hundreds of millions or more), across geographies, asset classes (businesses, real estate, art, trusts), the management burden becomes large. A family office provides a dedicated platform. (Bank of America Private Bank)

-

Control and confidentiality: Instead of outsourcing all decisions to external advisors, families may prefer to retain direct control, maintain privacy, align investments with family values—and a family office allows this. (Family Office)

-

Legacy and governance: Succession, inter-generational fairness, family governance, education of the next generation—these are often as important as returns. A family office can embed governance frameworks. (EY)

-

Economies of scale / cost efficiencies: For very large families, consolidating services—investment, tax, legal, real-estate management—under one roof may be more efficient. (Ocorian)

-

Flexibility across asset classes: Family offices increasingly seek investments in private markets, venture capital, real assets and infrastructure—beyond public markets. (Wealth Management Services)

In short: as families grow wealthier, more mobile and more multi-generational, the traditional model of “wealth is managed by a private bank” often is insufficient.

Types of Family Offices

We can categorize broadly:

-

Single Family Office (SFO): Serves only one family. Tailored, high control, potentially high cost. (Family Office)

-

Multi Family Office (MFO): Serves multiple families; shares infrastructure and cost among families. Often sits between a private-bank service and a full SFO. (Investopedia)

-

Virtual or Outsourced Family Office: For smaller-scale wealth or families who want “office-style” capabilities but don’t want full heavy infrastructure. They outsource many functions. (Business Insider)

Importantly, the “threshold” for when a family office makes sense has been moving. Historically families with hundreds of millions in assets were the domain; but now even smaller fortunes are exploring leaner models. (Business Insider)

Key Functions & Services

A well-structured family office will coordinate (among others):

-

Investment strategy and portfolio management (public & private markets)

-

Risk management, asset allocation, portfolio oversight

-

Tax planning, estate and trust structuring, succession planning

-

Philanthropy / impact giving

-

Real-estate management, luxury assets, lifestyle management (yachts, art, travel)

-

Family governance: setting family constitutions, education of next generation, family meetings

-

Reporting, accounting, communications across branches of the family

For instance, one article notes that “providing advice and services for ultra-wealthy families under a comprehensive wealth management plan … requires a well-coordinated, collaborative effort by a team of professionals from legal, insurance, investment, estate, business and tax disciplines.” (Investopedia)

Trends in 2025: What’s Changing?

The family-office world is evolving rapidly. Here are some of the key trends for 2025:

-

Asset class shift: According to a 2025 report by PricewaterhouseCoopers (PwC), family offices have increased their allocation to venture capital and private equity over the past decade. For example, the share of family-office investment in VC rose from 17 % in H2 2015 to 38 % in H1 2022, and remained ~31 % in H1 2025. (PwC)

-

At the same time, family offices are rediscovering real-estate and debt financing, increasing their share in those asset classes. (PwC)

-

Globalisation and jurisdictional diversification: Families are locating offices in different geographies, seeking favourable rules, talent, strategic proximity, not just tax advantages. (PwC)

-

Technology and infrastructure: With more complexity, family offices are investing in tech platforms (reporting, risk, integration) and even software vendors servicing family-office needs. (Forbes)

-

Governance & next-generation focus: The “soft” side—family values, inter-generational transfer, education—is getting more attention. For example, an EY/Julius Baer study noted 59 % of families had implemented wills or family constitutions. (EY)

-

Access for smaller wealth: As mentioned earlier, the family-office model is no longer exclusively for the ultra-rich. Smaller, leaner structures (virtual offices, hybrid arrangements) are gaining traction. (Business Insider)

These trends suggest that family offices are no longer passive “wealth warehouses” — they are strategic, active investment engines, governance platforms, and often global in reach.

Recent Real-Life Examples

To ground all this in real life, here are a few compelling examples of family offices in action.

Example 1: Cascade Investment (The family office of Bill Gates)

-

Cascade is the private investment vehicle for Bill Gates’ personal wealth (outside his Microsoft stake) and is often described as one of the largest family-office structures in the US. (Altss)

-

Its holdings are diverse: large stakes in companies (for example, one narrative states they held ~21 % of Ecolab) and significant real-estate/farmland holdings. (Simple)

-

Strategy: The family office supports Gates’s philanthropic ambitions (through the Foundation) but also runs a long-term investment engine focused on essential industries, long-term trends, stable cash flows. (Altss)

-

In our context this shows how a family office may (a) hold public equities, (b) hold real assets, (c) focus on long-term compounding rather than short-term trading — in line with a multi-generational mindset.

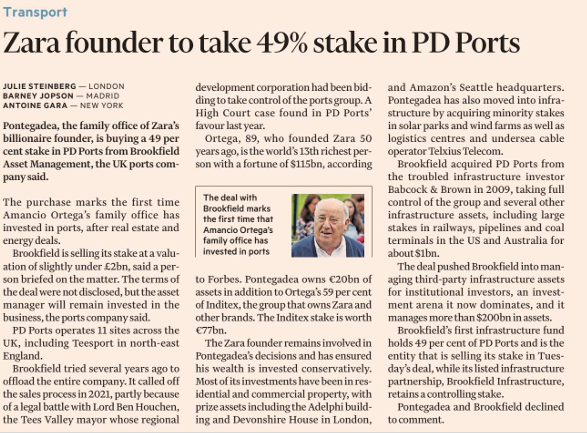

Example 2: Pontegadea Inversiones (Family office of Amancio Ortega – founder of Zara/Inditex)

-

A recent headline: In July 2025, it was reported that Pontegadea agreed to acquire a 49 % stake in UK-based logistics and ports company PD Ports from Brookfield Asset Management — marking a further diversification into infrastructure/operating assets. (Reuters)

-

Historically Pontegadea has held a major global real-estate portfolio (office towers, luxury retail, major commercial assets) in cities like London, New York, Miami, etc. (InforCapital)

-

What lessons this gives: even a family office founded on retail-commerce wealth (Zara) is shifting toward infrastructure, global diversification, long-term assets with strong cash flows and growth potential.

Example 3: Indian Family Offices & Start-up Investments

-

An article from August 2025 noted that in Gujarat, traditional business dynasties are increasingly making direct allocations to start-ups (consumer tech, agritech, fintech) and acting more like venture investors, rather than just passive wealth stewards. (The Times of India)

-

Similarly, data shows that Indian family offices are increasingly listed in directories of start-up investors (e.g., “Family Office Tracker: Here’s The List Of 200+ Investors Betting Big On Startups” from Inc42) for the India market. (Inc42 Media)

-

Insight: This shows the extension of the family-office concept in emerging markets — not just preserving legacy wealth but active investing in new high-growth opportunities.

What Value Does a Family Office Provide?

From the above, we can summarise key value-propositions:

-

Holistic management: Coordinated management across investments, tax, estates, real estate, lifestyle, philanthropy

-

Tailored to family needs: Rather than off-the-shelf wealth-management, the family office can reflect the family’s values, risk-tolerance, inter-generation goals

-

Long-term horizon: Family offices often think in decades rather than quarters — enabling illiquid, high-reward investments (venture, infrastructure)

-

Governance and succession: By embedding structures (family charters, education, governance), they help maintain family unity and avoid the “rich family fall‐apart” story

-

Cost-efficiencies at scale: For very large families, running a dedicated office may yield cost savings (and better performance) compared to siloed advisors

-

Diverse asset access: Ability to allocate to private markets, real assets, direct deals, infrastructure, which may not be available to typical retail wealth-structures

Thus, a well-executed family office offers both financial and non-financial benefits to a wealthy family concerned about legacy, continuity, control and values.

Challenges & Risks

However, it’s not all smooth sailing. Some of the major risks include:

-

Cost and scale: Setting up a full SFO is expensive (staff, systems, infrastructure). Some estimates suggest net worth of at least US $100 million (or more) may be required. (Investopedia)

-

Governance failures: Without robust governance, many family offices fail or lead to family conflicts, poor investments or misalignments.

-

Regulatory/compliance risks: Family offices may face regulatory scrutiny (especially when making large direct investments). The US rule-set, for example, has specific exemptions. (web.acaglobal.com)

-

Illiquidity and risk concentration: Investing in private markets or real estate may increase illiquidity, lock-in, and concentration risk.

-

Succession risk: The transition from one generation to the next is fraught; if values, incentives, governance aren’t aligned, wealth can erode.

-

Over-complexity: Some families may over-engineer structures, losing agility. The leaner models (virtual offices) may be more appropriate for smaller wealth.

The recent PwC data shows that the value and volume of family-office deals have suffered a setback in the most recent cycle (July 2023-June 2025) — indicating that the space is not immune to macroeconomic headwinds. (PwC)

What Should Families Considering a Family Office Ask?

If you are advising a family (or part of one) thinking of setting up a family office, some key questions to explore:

-

What is the core purpose? Wealth preservation? Growth? Philanthropy? Lifestyle? Succession?

-

What is the family governance framework? Who makes decisions? What are family values? How is the next generation educated and engaged?

-

What asset-allocation strategy makes sense? Given the size, risk tolerance, time horizon: public vs private, direct vs funds, geography.

-

What legal and tax structure is appropriate? Location of office, trusts/LLPs, regulatory environment.

-

What operational model? Full in-house (SFO), outsourced (virtual or hybrid), multi-family shared, or combination.

-

What technology and data systems? Reporting, dashboards, consolidation, risk monitoring.

-

How to manage costs, talent, and oversight? Hiring staff, avoiding drift, aligning incentives.

-

What succession and exit plans exist? For both the office itself (what happens if family chooses to close it) and for future generations.

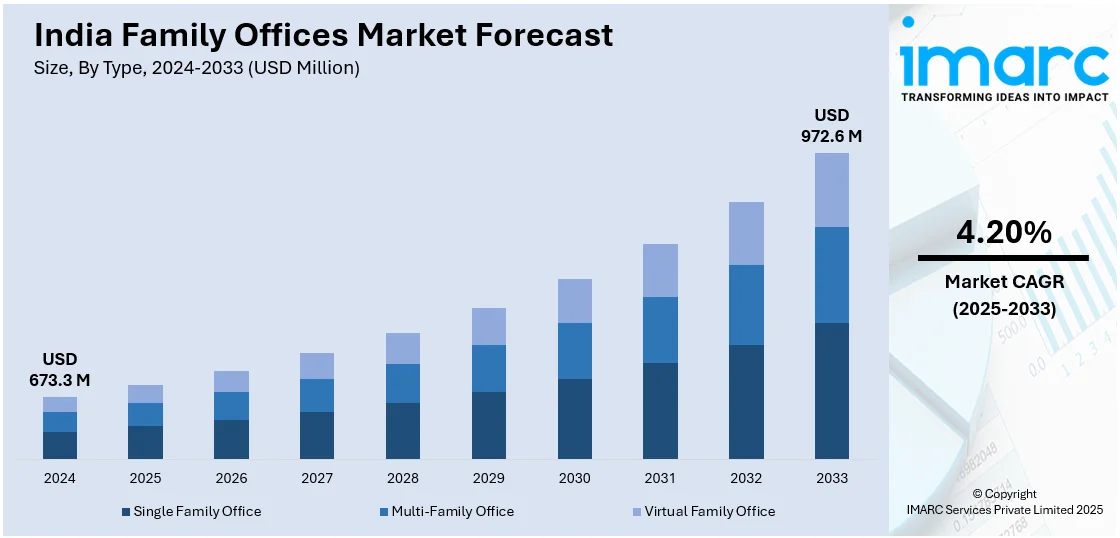

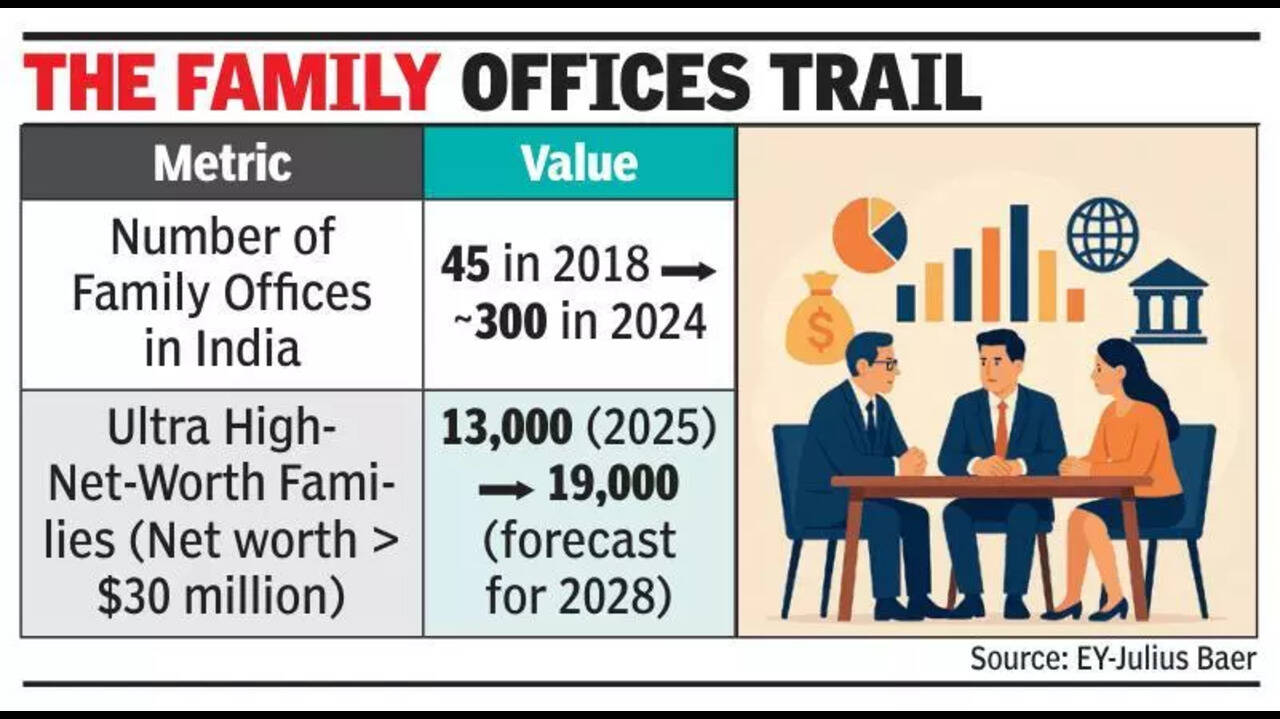

Relevance to India & Emerging Markets

For Indian families (or families in emerging markets) the family-office model is particularly relevant:

-

India has seen a surge in family offices (or “family business offices”) investing in startups, venture capital and alternative assets. (Inc42 Media)

-

As wealth crosses generations, and globalisation continues (mobility, cross-border assets, philanthropy, second homes abroad), the complexity increases — making a family office structure more relevant.

-

Regulatory/tax considerations: India has its own set of regulatory rules, for example around trusts/laws/regime for family offices may differ; families will need to adapt global models to local context.

-

Capital-allocation choices: Families may migrate from traditional Indian asset classes (real estate, fixed income) towards global equities, private markets, technology or even ESG assets. Indeed, one report noted 25 % of family offices prioritise asset preservation but are actively eyeing global alternatives. (EY)

For someone like you (given your diverse interests, e.g., converting land into carbon-storing project etc), the family-office lens is useful: it reminds us that these structures aren’t just about investing money but aligning investment with mission (e.g., climate, sustainability, inter-generational legacy).

Key Takeaways

-

A family office is a highly customised private vehicle for managing a wealthy family’s assets, governance, succession, philanthropy and lifestyle.

-

With global wealth rising and complexity increasing, family offices are expanding in number, scope and sophistication — beyond the “old money” archetype.

-

Major trends for 2025: more direct/private market investing, greater use of infrastructure/real-assets, increased technology adoption, more global diversification, and more access/more flexible models for smaller wealth.

-

Real-life examples (Cascade, Pontegadea, Indian family offices) show how the model is being applied in varied contexts.

-

While there are definite advantages, setting up and running a family office involves decisions around cost, governance, structure, talent and succession — and families must carefully assess whether a full SFO, a lean hybrid or outsourced model is right for them.

-

For families in India or emerging markets, the family-office idea offers a compelling framework: aligning wealth management, mission, legacy and generational transition in one integrated structure.

Final Thoughts

In the era of globalisation, rapidly changing asset classes (cryptocurrency, venture capital, climate-tech), cross-border mobility, and heightened inter-generational expectations, the family office is more than a financial vehicle; it's a platform for family continuity, aligned values, strategic capital deployment and legacy creation.

For families that ask, “How do we ensure that our wealth and values persist for generations, not just our lifetime?” — the family-office model offers one mature answer. It combines investment, governance, mission and operational discipline in a way that traditional wealth-management may not.

If you are exploring starting a family office (or thinking how to structure your wealth or engage future generations) then the key is to begin with purpose, build governance, choose an asset strategy, select the right operational model and ensure that the architecture remains aligned with the family’s identity and long-term vision.